- What should your loan processor’s resume include?

- How can you create a professional summary?

- How should you describe your work experience as a loan processor?

- Include a fitting loan processor education and certifications section

- Which key skills are relevant for a loan processor?

- How to select the most impactful loan processor resume template

- Copyable loan processor resume example

- Key takeaways for writing a loan processor resume

To be a successful loan processor, you need to be organized, analytical, and have a knack for solving problems. Since the job market is so competitive, you will need to show a hiring manager you have the skills they are looking for. You also want to craft a resume that will create a positive impression of you and your skills. By using our resume example and writing guide, you can do just that. Here is what we will cover:

To be a successful loan processor, you need to be organized, analytical, and have a knack for solving problems. Since the job market is so competitive, you will need to show a hiring manager you have the skills they are looking for. You also want to craft a resume that will create a positive impression of you and your skills. By using our resume example and writing guide, you can do just that. Here is what we will cover:

What should a loan processor’s resume include?

Advice on each section of your resume (summary, work history, education)

Adding relevant key skills to your resume

Choosing the right resume template for a loan processor

What should your loan processor’s resume include?

Showing you are organized and have great customer service skills are two of the most important things you should include throughout your resume. You should also showcase how you have identified opportunities for improvement and have proactively resolved issues in previous roles. These skills should be found throughout the following sections:

The resume header with your contact information

The resume summary

The employment history section

The resume skills section

The education section

How can you create a professional summary?

Professionalism counts as a loan processor, and that is something you should portray in your professional summary. Start your summary with a strong statement that grabs the hiring manager’s attention and highlights your experience. Then, identify any key skills, qualifications, and abilities you have that will make you the perfect loan processor. If you are familiar with any specific loan processing methods or software, finish your professional summary by mentioning them briefly.

When picking the terms you want to include, use the original job listing as a guide. Use the skills mentioned in the listing whenever possible and customize this list for each position you apply for.

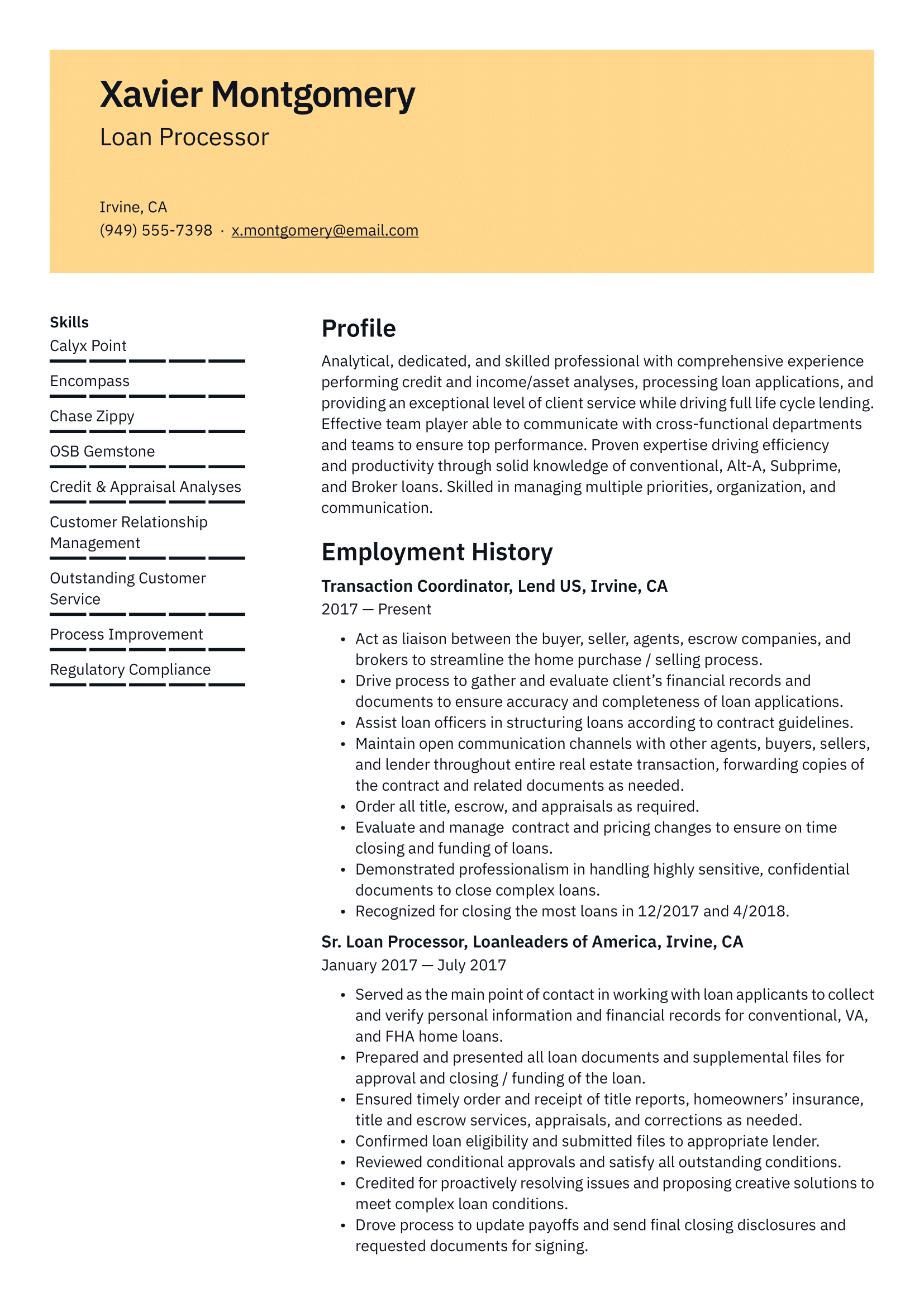

See our adaptable loan processor summary below.

Analytical, dedicated, and skilled professional with comprehensive experience performing credit and income/asset analyses, processing loan applications, and providing an exceptional level of client service while driving full life cycle lending. Effective team player able to communicate with cross-functional departments and teams to ensure top performance. Proven expertise driving efficiency and productivity through solid knowledge of conventional, Alt-A, Subprime, and Broker loans. Skilled in managing multiple priorities, organization, and communication.

How should you describe your work experience as a loan processor?

When you are ready to move on to your work experience section, include quantifiable achievements with each position. Some examples might be your processing times, customer satisfaction scores, or loan approval rates. If you don’t have access to these metrics, give examples of how you’ve improved processes or addressed a problem.

Write out your career experience section in reverse chronological order. Your most recent position is listed first followed by a summary of your duties. You should also include a bullet point list that acknowledges some of your contributions in each role.

Take a look at the adaptable loan processor resume employment history section below.

Transaction Coordinator at Lend US, Irvine, CA 2017 - Present

Act as liaison between the buyer, seller, agents, escrow companies, and brokers to streamline the home purchase / selling process.

Drive process to gather and evaluate client’s financial records and documents to ensure accuracy and completeness of loan applications.

Assist loan officers in structuring loans according to contract guidelines.

Maintain open communication channels with other agents, buyers, sellers, and lender throughout entire real estate transaction, forwarding copies of the contract and related documents as needed.

Order all title, escrow, and appraisals as required.

Evaluate and manage contract and pricing changes to ensure on time closing and funding of loans.

Demonstrated professionalism in handling highly sensitive, confidential documents to close complex loans.

Recognized for closing the most loans in 12/2017 and 4/2018.

Sr. Loan Processor at Loanleaders of America, Irvine, CA Jan, 2017 - Jul, 2017

Served as the main point of contact in working with loan applicants to collect and verify personal information and financial records for conventional, VA, and FHA home loans.

Prepared and presented all loan documents and supplemental files for approval and closing / funding of the loan.

Ensured timely order and receipt of title reports, homeowners’ insurance, title and escrow services, appraisals, and corrections as needed.

Confirmed loan eligibility and submitted files to appropriate lender.

Reviewed conditional approvals and satisfy all outstanding conditions.

Credited for proactively resolving issues and proposing creative solutions to meet complex loan conditions.

Drove process to update payoffs and send final closing disclosures and requested documents for signing.

Identified areas of improvement and provided solutions to management team to streamline workflow processes.

Maintained open communication with borrowers, managers, sales, document drawer, funder, underwriting, and title / escrow to keep all parties updated on the application status.

Home / Support Service Specialist at Bank of America, Brea, CA 2011 - 2017

Analyzed income and asset documentation prior to submission of loans for underwriting review.

Supported processing team in ordering, obtaining, and evaluating title reports, homeowners’ insurance, title and escrow services, appraisals, and corrections.

Prepared and sent initial disclosure packages. Requested additional necessary documentation from borrowers. Confirmed loan information and submitted files to closing departments to sign and close loans.

Cleared conditions and issued changes to terms on previously approved loans. Informed borrowers of application status. Communicated regularly with sales and underwriting teams.

Maintained lowest number of aged files older than 45 days.

Streamlined process to request titles, appraisals, and verifications; provided feedback and assisted peers with load leveling, system use, and policy evolution.

Developed and implemented daily workflows and tracked job tasks to create timing analytics for upper management.

Selected to conduct user acceptance testing of new software solutions to comply with TRID.

Played a key role in resolving system hard-stop workarounds and processes.

Show that you pay attention to the small details

According to Experian, loans have grown in number by nearly 20% since 2020. That means loan processors need to be able to work quickly and have great attention to detail. Showing you have this skill can be highly beneficial on your resume.

What can you do without any relevant experience?

It isn’t uncommon for someone without a loan processing background to enter the industry. If this applies to you, your resume should reflect the transferable skills that will make you successful in this role. Focus on your ability to solve problems and critically think, and also highlight your customer service skills.

Include a fitting loan processor education and certifications section

Formal education isn’t required in the role of a loan processor, but it is a good idea to include any education and certifications that you do have. This could include any type of coursework you’ve completed. Here are some examples of what you might include:

Coursework. Even if you haven’t graduated college but have attended some classes, you can include this on your resume. An example might be “Coursework toward…” and then add your area of study.

Software proficiencies. Since this is a role that requires quite a bit of technological know-how, incorporating what programs you are experienced with can be beneficial. If you have worked with popular loan processing software before, the education section is the perfect place to mention it.

Coursework in General Studies at Orange Coast Community College, Costa Mesa, CA

Which key skills are relevant for a loan processor?

As a loan processor, you will be responsible for performing analysis about loan applicants, processing their applications, and providing end-to-end loan life cycle services. A hiring manager will search your resume for the skills needed to complete the job in a way that keeps customers satisfied.

We include some examples of the skills you may want to include in our resume example, but you can also draw inspiration from the job description. Keep in mind that many hiring managers run resumes through an applicant tracking system that searches for the skills mentioned in their job description. (If you want to learn more about how an ATS works, check out our article Resume ATS optimization.)

For a loan processor, a few critical skills might include:

Credit analysis

Relationship management

Customer service

Quality control

Appraisals

Document processing

Data entry

How to select the most impactful loan processor resume template

The resume template you choose for your loan processor resume needs to be professional and easy to read. You should also choose a format that is compact but gives enough space to provide details of your job history. In this role, it isn’t necessary to limit yourself to just one page, but you should limit your resume to two pages.

You’ll find many templates in our resume builder that you can draw inspiration from. While there, check out over 100 resume examples we have available to get inspired.

Copyable loan processor resume example

Summary example

Analytical, dedicated, and skilled professional with comprehensive experience performing credit and income/asset analyses, processing loan applications, and providing an exceptional level of client service while driving full life cycle lending. Effective team player able to communicate with cross-functional departments and teams to ensure top performance. Proven expertise driving efficiency and productivity through solid knowledge of conventional, Alt-A, Subprime, and Broker loans. Skilled in managing multiple priorities, organization, and communication.

Employment history example

Transaction Coordinator at Lend US, Irvine, CA 2017 - Present

Act as liaison between the buyer, seller, agents, escrow companies, and brokers to streamline the home purchase / selling process.

Drive process to gather and evaluate client’s financial records and documents to ensure accuracy and completeness of loan applications.

Assist loan officers in structuring loans according to contract guidelines.

Maintain open communication channels with other agents, buyers, sellers, and lender throughout entire real estate transaction, forwarding copies of the contract and related documents as needed.

Order all title, escrow, and appraisals as required.

Evaluate and manage contract and pricing changes to ensure on time closing and funding of loans.

Demonstrated professionalism in handling highly sensitive, confidential documents to close complex loans.

Recognized for closing the most loans in 12/2017 and 4/2018.

Sr. Loan Processor at Loanleaders of America, Irvine, CA Jan, 2017 - Jul, 2017

Served as the main point of contact in working with loan applicants to collect and verify personal information and financial records for conventional, VA, and FHA home loans.

Prepared and presented all loan documents and supplemental files for approval and closing / funding of the loan.

Ensured timely order and receipt of title reports, homeowners’ insurance, title and escrow services, appraisals, and corrections as needed.

Confirmed loan eligibility and submitted files to appropriate lender.

Reviewed conditional approvals and satisfy all outstanding conditions.

Credited for proactively resolving issues and proposing creative solutions to meet complex loan conditions.

Drove process to update payoffs and send final closing disclosures and requested documents for signing.

Identified areas of improvement and provided solutions to management team to streamline workflow processes.

Maintained open communication with borrowers, managers, sales, document drawer, funder, underwriting, and title / escrow to keep all parties updated on the application status.

Home / Support Service Specialist at Bank of America, Brea, CA 2011 - 2017

Analyzed income and asset documentation prior to submission of loans for underwriting review.

Supported processing team in ordering, obtaining, and evaluating title reports, homeowners’ insurance, title and escrow services, appraisals, and corrections.

Prepared and sent initial disclosure packages. Requested additional necessary documentation from borrowers. Confirmed loan information and submitted files to closing departments to sign and close loans.

Cleared conditions and issued changes to terms on previously approved loans. Informed borrowers of application status. Communicated regularly with sales and underwriting teams.

Maintained lowest number of aged files older than 45 days.

Streamlined process to request titles, appraisals, and verifications; provided feedback and assisted peers with load leveling, system use, and policy evolution.

Developed and implemented daily workflows and tracked job tasks to create timing analytics for upper management.

Selected to conduct user acceptance testing of new software solutions to comply with TRID.

Played a key role in resolving system hard-stop workarounds and processes.

Education example

Coursework in General Studies at Orange Coast Community College, Costa Mesa, CA

Skills example

Calyx Point

Encompass

Chase Zippy

OSB Gemstone

Credit & Appraisal Analyses

Customer Relationship Management

Outstanding Customer Service

Process Improvement

Regulatory Compliance

Key takeaways for writing a loan processor resume

When designing your loan processor resume, focus on your abilities to improve processes if you don’t have many quantifiable achievements.

Attention to detail and good organization skills are important on a loan processor’s resume due to the increase in the number of loan applications in recent years.

If you lack formal education, mention any coursework or specific training you’ve had that will make you successful in this role.